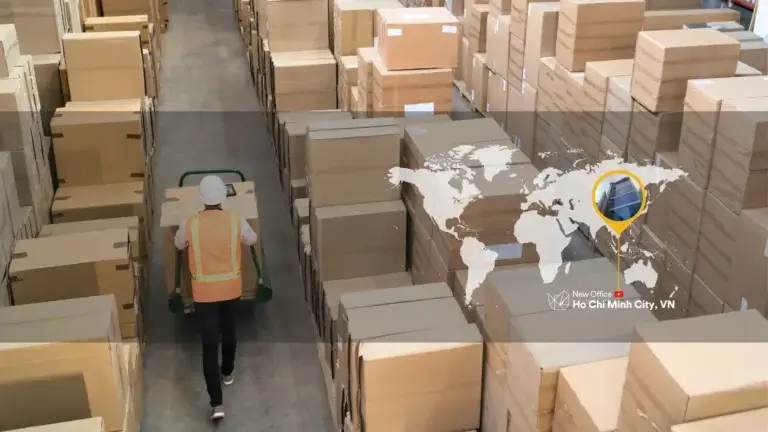

By INNORHINO – Your Packaging Design & Export Compliance Partner in Vietnam

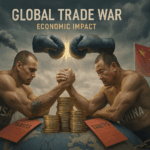

As international brands diversify sourcing beyond China, Vietnam has quickly become a manufacturing powerhouse. However, shifting production is just one part of the equation. To fully benefit from cost savings and market access, brands must ensure smooth customs clearance and leverage trade documentation like Certificate of Origin Form B (C/O Form B).

At INNORHINO, we don’t just provide export-ready packaging—we help you navigate trade compliance confidently. Here’s what global buyers need to know about the 2025 updates to C/O Form B and how to stay ahead.

- What Is C/O Form B—and Why It Matters

- Regulatory Update: MoIT Now Sole Authority (Effective May 5, 2025)

- Our Compliance Support—Beyond Packaging

- When Do You Need C/O Form B?

- 📊 Origin Criteria for C/O Form B Eligibility

- 📄 Required Documents for C/O Form B (MoIT, 2025)

- From Packaging to Paperwork—We Help You Move Forward

- Why Vietnam Is a Smart Move

- 🧩 FAQ: C/O Form B and Trade Compliance in Vietnam

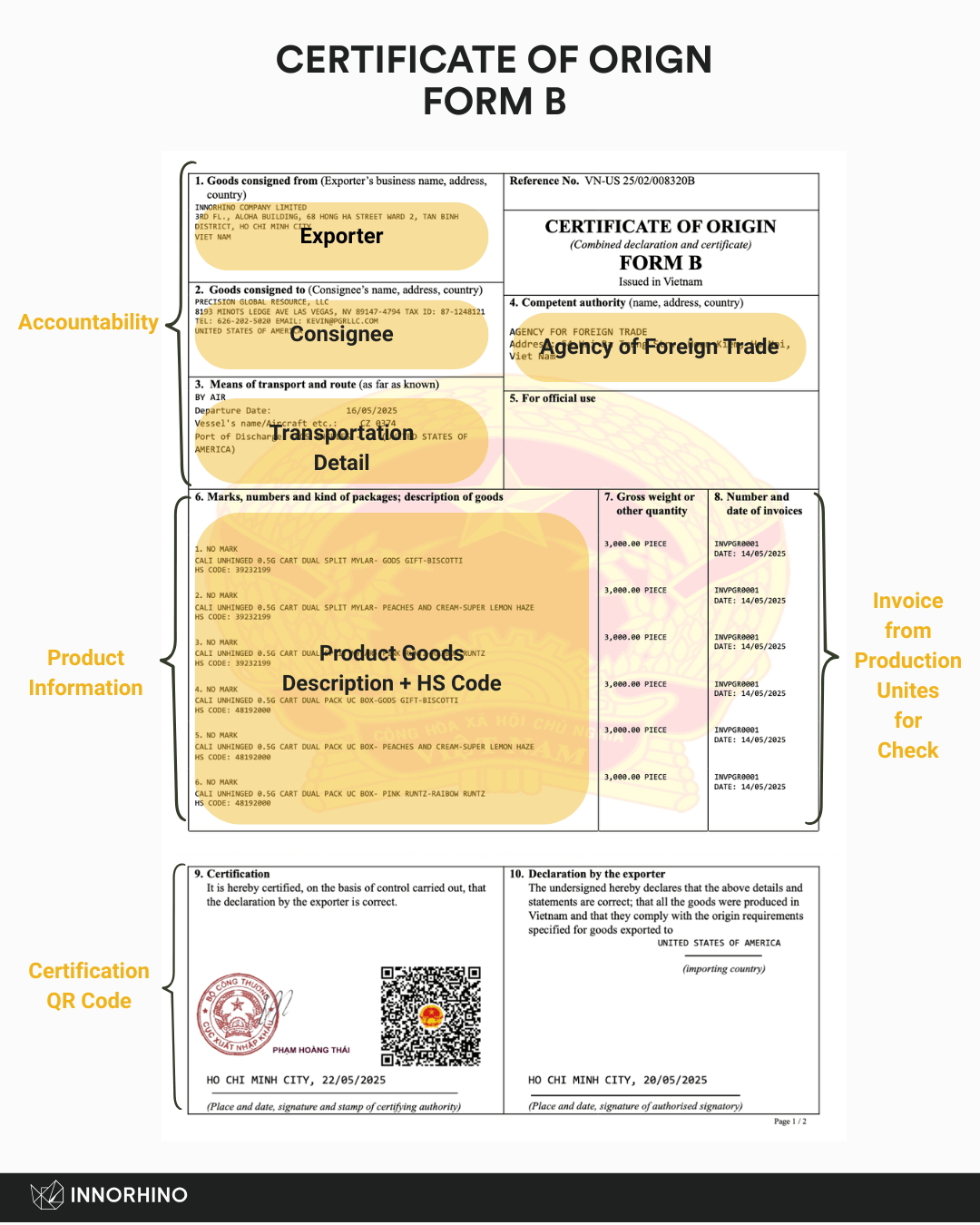

What Is C/O Form B—and Why It Matters

A Certificate of Origin Form B confirms that goods originate in Vietnam and qualifies them for preferential tariff treatment under agreements like the Asia-Pacific Trade Agreement (APTA).

Here’s why it’s critical for global brands:

- ✅ Unlock Tariff Reductions

Access lower or zero import duties when exporting to key markets such as South Korea, Japan, and China. - ✅ Accelerate Customs Clearance

Avoid delays, penalties, or inspections by proving the origin of your products. - ✅ Reinforce Brand Authenticity

Especially important for regulated or premium products like food, cosmetics, or electronics. - ✅ Meet Trade Agreement Requirements

A valid C/O is often required to claim tariff benefits under FTAs.

Regulatory Update: MoIT Now Sole Authority (Effective May 5, 2025)

In a major regulatory shift, the Ministry of Industry and Trade (MoIT) is now the exclusive issuer of all Certificates of Origin, including Form B.

What’s Changed:

- 🛑 VCCI (Vietnam Chamber of Commerce and Industry) is no longer authorized.

- 🏛 Centralized issuance improves oversight and reduces origin fraud.

- 🌐 Digital submission through the national eCoSys platform streamlines the application process.

✅ Tip: Begin transitioning your processes now to align with the updated system and avoid export delays.

Our Compliance Support—Beyond Packaging

At INNORHINO, we partner with global buyers to ensure their shipments are packaged, documented, and customs-ready.

Here’s how we help:

- 📄 Guide you through C/O Form B requirements and supporting documents.

- 📦 Ensure your packaging meets destination country regulations, including strength testing, sustainability, and labeling.

- 🤝 Work with your Vietnamese suppliers to coordinate production and export documentation.

When Do You Need C/O Form B?

You likely need a C/O Form B if your brand is:

- 🔁 Transitioning sourcing from China to Vietnam

- 🌍 Exporting to tariff-sensitive markets like the USA, EU, Japan, or Korea

- 📦 Launching new SKUs or working with new Vietnamese suppliers

- 🔒 Operating in regulated industries (food, personal care, electronics)

📊 Origin Criteria for C/O Form B Eligibility

To obtain Form B, products must meet one of these origin rules:

| Rule | Definition |

| CTSH | Change in Tariff Sub-Heading: Finished product has a different HS code at the 6-digit level compared to imported materials. |

| LVC | Local Value Content: At least 30% of the product’s value must be added in Vietnam. |

| WO | Wholly Obtained: All inputs and processes occur in Vietnam (e.g., agriculture, fishery). |

We help assess which rule applies and what documentation is needed.

📄 Required Documents for C/O Form B (MoIT, 2025)

All documents must be submitted via the eCoSys digital platform:

- Digital application form

- Commercial invoice

- Bill of lading or airway bill

- Sales contract

- Proof of payment

- Certificate of manufacturing origin (if applicable)

- Production records proving CTSH, LVC, or WO compliance

From Packaging to Paperwork—We Help You Move Forward

By working with INNORHINO, you gain more than a box supplier—you gain a strategic compliance partner.

We help you:

- Pass customs checks with compliant packaging and documentation

- Align export documents with production and shipping timelines

- Gather and verify necessary proof of origin

- Support your freight forwarder or customs broker with prepared paperwork

Why Vietnam Is a Smart Move

Sourcing from Vietnam offers significant advantages:

- Access to FTAs like EVFTA, CPTPP, and RCEP

- A skilled workforce in consumer goods, light industry, and packaging

- Strong logistics infrastructure for regional and global trade

- Preferential tariffs when using C/O Form B

Whether you’re launching a new production line or shifting suppliers from China to Vietnam, we’re ready to support you with packaging and compliance that ship smarter.

📧 Contact us for a tailored consultation or packaging sample.

We don’t just deliver boxes—we deliver confidence.

🧩 FAQ: C/O Form B and Trade Compliance in Vietnam

A: No, but it’s essential for goods seeking tariff preferences under trade agreements.

A: Electronics, textiles, food & beverage, cosmetics, and consumer goods are top users.

A: Yes—if they’re experienced. INNORHINO supports clients with document coordination and compliance checks.

A: Typically 1–3 business days if documents are correct. Faster with expert guidance.

A: No. As of May 5, 2025, only the Ministry of Industry and Trade is authorized.