Introduction

In 2025, U.S. tariffs on Chinese imports, including packaging materials, escalated to unprecedented levels, reaching up to 45%. This surge has compelled American brands to reassess their supply chain strategies. Amidst these challenges, Vietnam emerges as a viable alternative for sourcing packaging solutions.

Understanding the Tariff Issue

In 2025, the U.S. government introduced a major shift in trade policy by increasing tariffs on Chinese imports. On February 1, an executive order announced a new 10% base tariff on all goods coming from China, with certain categories facing increases of up to 35%. The move is part of a broader effort to reduce dependence on Chinese manufacturing and promote domestic production.

Just a month later, starting at 12:01 a.m. on March 4, the tariff rate on Chinese imports rose again — this time from 10% to 20%. Importantly, this new tariff is applied on top of existing Section 301 tariffs that were put in place during the Trump and Biden administrations. As a result, some products imported from China are now subject to combined tariff rates as high as 45%, not including standard customs duties. (Federal Register notice)

For example:

A company that previously imported $1 million worth of packaging from China and paid $250,000 in tariffs (based on a 25% rate under Section 301) will now face a 45% total tariff. That means their new tariff bill will be $450,000 — an increase of $200,000, or 80%.

This significant cost increase puts pressure on profit margins and forces many businesses to rethink their supply chains, with more companies now seeking alternatives outside of China.

How Tariffs Directly Impact U.S. Brands

1. Profit Margin Compression

Packaging can constitute up to 25% of a product’s total cost. With tariffs increasing these expenses, industries such as cosmetics, electronics, food, and beverages are experiencing significant profit margin reductions.

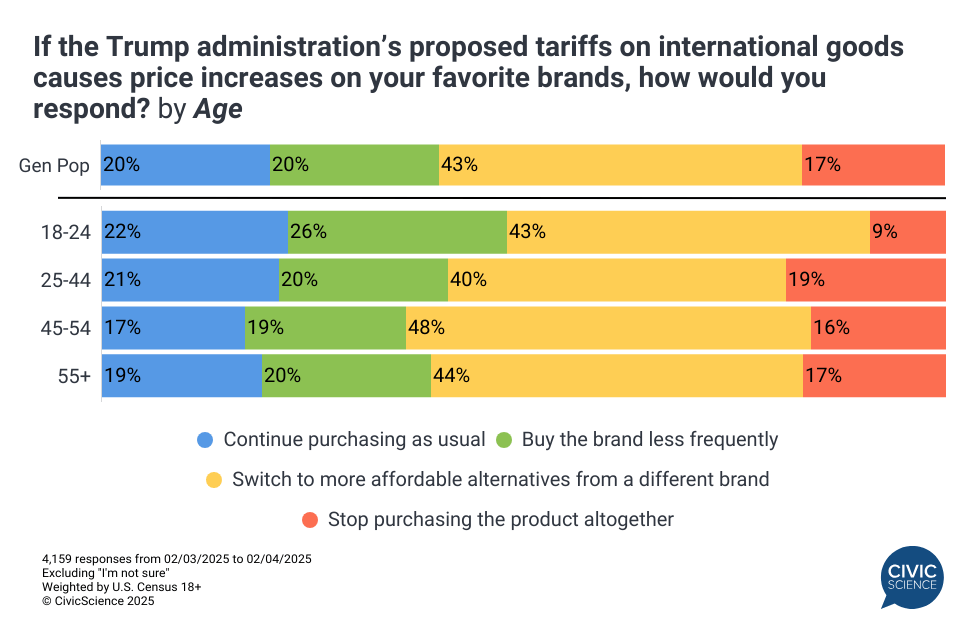

2. Consumer Price Sensitivity

Brands face the dilemma of absorbing higher costs or passing them onto consumers. Price hikes risk reduced demand and loss of market share.

3. Supply Chain Vulnerability

Overreliance on Chinese suppliers exposes brands to geopolitical risks and logistical disruptions, highlighting the need for supply chain diversification.

Vietnam as the Leading Alternative for Packaging

Vietnam has emerged as a manufacturing powerhouse, offering several advantages:

- Competitive Costs: Lower labor and operational expenses compared to China.

- Advanced Manufacturing: Capabilities in producing diverse packaging materials, including plastics, paper, and metals.

- Favorable Trade Relations: Benefiting from trade agreements with the U.S., many Vietnamese products enjoy reduced tariff barriers.

- Strategic Location: Proximity to major shipping routes enhances logistics efficiency.

Vietnam’s packaging industry has seen substantial growth, with exports reaching new markets globally.

Strategic Solutions for Brands

1. Partner with Vietnamese Suppliers

Establishing relationships with reliable Vietnamese manufacturers can mitigate tariff impacts and ensure supply chain resilience.

2. Embrace Sustainable Packaging

Vietnam is advancing in sustainable packaging solutions, offering eco-friendly materials that appeal to environmentally conscious consumers.

3. Optimize Packaging Design

Collaborating with Vietnamese suppliers to redesign packaging can lead to material reduction and cost savings.

4. Conduct a Tariff Impact Audit

Regular assessments of tariff effects on the packaging portfolio can identify areas for cost reduction and supply chain improvement.

Final Thoughts

The evolving tariff landscape necessitates proactive strategies. By exploring alternatives like sourcing from Vietnam, U.S. brands can navigate these challenges effectively, maintaining competitiveness and ensuring long-term growth.

How INNORHINO Can Help

At INNORHINO, we specialize in connecting U.S. brands with cost-effective, high-quality packaging solutions through our network of Vietnamese manufacturing partners. Our services include:

- Sustainable Packaging Options: Eco-friendly materials that meet global standards.

- Custom Design Support: Tailored packaging solutions that align with your brand identity.

- End-to-End Logistics Coordination: Streamlined processes from production to delivery.

- Competitive Pricing: Leveraging Vietnam’s cost advantages to offer attractive pricing.

Ready to transform your packaging strategy?

📩 Contact INNORHINO today for a personalized consultation.

Frequently Asked Questions (FAQ)

Q1: Why have U.S. tariffs on Chinese packaging increased in 2025? The U.S. government implemented higher tariffs to encourage domestic manufacturing and reduce reliance on Chinese imports

Q2: Are Vietnamese packaging products subject to U.S. tariffs? Due to favorable trade agreements, many Vietnamese packaging products enjoy reduced or no tariffs when entering the U.S. market

Q3: How can I find reliable packaging suppliers in Vietnam? Partnering with firms like INNORHINO can connect you with vetted Vietnamese manufacturers with proven export capabilities

Q4: What types of packaging does Vietnam produce? Vietnam offers a wide range of packaging solutions, including corrugated boxes, rigid gift boxes, paper bags, pouches, metal tins, and bioplastics

Q5: Is the quality of Vietnamese packaging comparable to Chinese products? Yes, Vietnamese factories often provide packaging of equal quality, with faster lead times and greater design flexibility